By Admin, LegalFormatsIndia.com

Dec 8, 2020

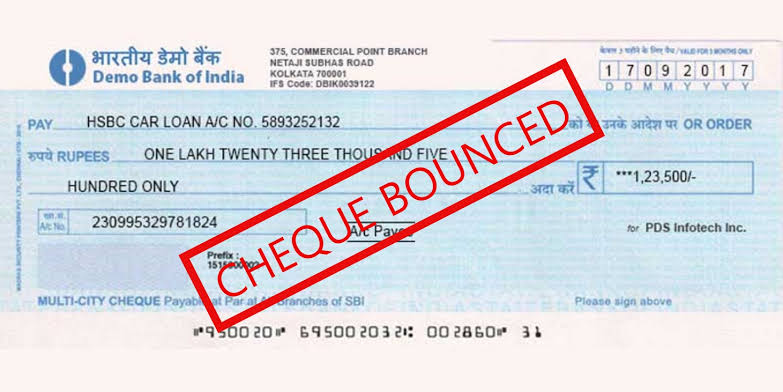

A. (i) Under Section 7 of the Negotiable Instrument Act,1881 (“the Act”), the person who issues and signs the cheque is known as the “Drawer”, the person directed to pay i.e., the bank in this case is known as the “Drawee” and the person in whose favour the cheque is issued is known as the “Payee”.

(ii) If the cheque issued by the Drawer in discharge of any debt or other liability is returned unpaid by the Bank to the Payee due to insufficiency of funds or for the reason that the said amount of cheque exceeds the amount arranged to be paid from that account of the Drawer by an agreement with the Bank, then such a circumstance would amount to cheque bounce or dishonor of cheque. However, dishonor of cheque is, by itself, not an offence under Section 138 of the Act. To constitute an offence u/s 138 of the Act, the procedure as hereinbelow mentioned must be strictly complied with. The relevant provisions for the same are contained under Sections 138 to 147 of the Negotiable Instruments Act, 1881.

Procedure for filing cheque bounce case:

When a cheque is returned unpaid/bounced/dishonored by the Bank, the Payee should not wait to receive the said cheque amount according to the convenience of the Drawer. If required steps are not initiated and completed within the prescribed time limit as mentioned in the Act, the chances of recovering the amount would become minimal and would absolve the Drawer from criminal liability.

Followings are the steps and process to be initiated: –

(a) Cheque must be deposited within 3 (three) months from the date mentioned on the Cheque.

(b) If the cheque is returned unpaid/bounced/dishonoured from the Bank, the Payee must collect the dishonoured cheque alongwith the bank slip or return memo from the Bank immediately.

(c) Thereafter, the Payee must send a Legal/Statutory Notice to Drawer of cheque within 30 (thirty) days from the date of receipt of intimation of dishonor of cheque from the Bank through recognised post with acknowledgment, calling upon the Drawer to make payment of the dishonored cheque within 15 (fifteen) days’ time from the receipt of the said Notice. The said Notice must specify all relevant facts and requisite details contained in the Act. If 30 (thirty) days are already elapsed after return of the dishonoured cheque and the said notice is not sent, the Payee may present the cheque with the bank provided the cheque has not become outdated.

(d) (i) If the Drawer of the cheque is an individual, consider sending notice to the right individual at the right address.

(ii) If the Drawer of the cheque is a sole proprietary firm, preferably notice should be sent to the Proprietor as also the Firm at the right addresses.

(iii) If the Drawer of the cheque is a Partnership Firm, notice should be sent to the Partnership Firm as also all the Partners of the Firm at the right addresses.

(iv) If the Drawer of the cheque is a Limited Liability Partnership (LLP), notice should be sent to LLP and its Designated Partners who are engaged in day-to-day management and control of the LLP at the right addresses.

(v) If the Drawer of the cheque is a Private Limited or Public Limited Company, notice should be sent to company as also to its Directors who are engaged in day-to-day management and control of the Company at the right addresses.

(e) If the Payee (holder of the Cheque) sends legal notice for payment of the dishonoured cheque amount against returned cheque and the Drawer does not pay the dishonoured amount within 15 (fifteen) days of receipt of the said Notice and/or refuses to make payment by responding to the said Notice and/or fails to respond to the said Notice, the Payee can file a criminal complaint under Section 138 of Negotiable Instruments Act, 1881 within one month from the date of expiry of the period specified in the said Notice, in the court where the cause of action has taken place.

B. The offence committed under Section 138 of the Act is punishable with imprisonment upto two years or with fine which may extend to twice the amount of the dishonoured cheque or with both.